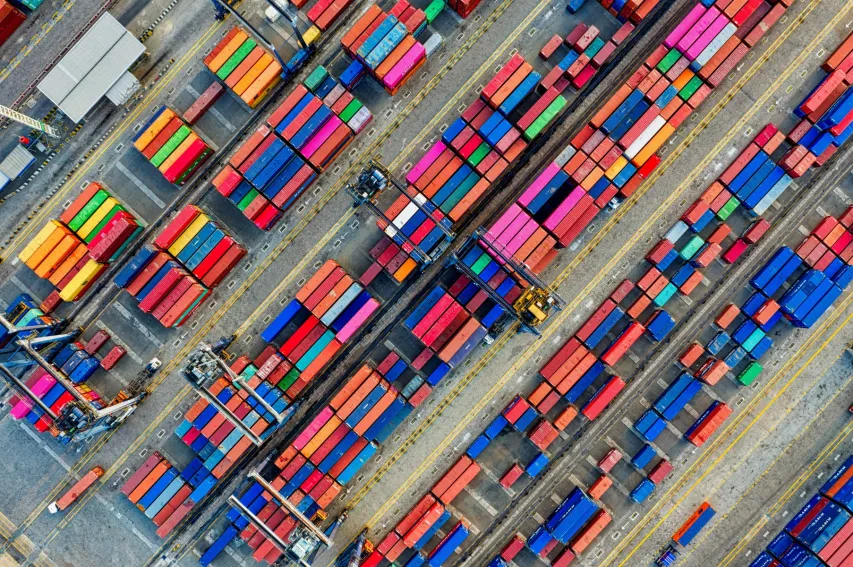

COSCO, OOIL to see stronger growth in Q3: report

This comes after posting a record-high quarterly revenue and net profit in the second quarter.

The container shipping industry is expected to see stronger growth in the third quarter of the year, after COSCO and the Orient Overseas (International) Limited (OOIL) posted record-high revenue and net profit in the second quarter.

COSCO announced that it expects a positive profit after posting a net profit of RMB37.09b (approximately US$5.72b) in the first half of 2021, up from RMB1.13b (US$174m) in 2020. This was driven by stronger freight rates with China Containerized Freight Index increasing 134% year-on-year (YoY).

Jefferies estimated that with this projection, the second quarter net profit stands at RMB21.6b (US$3.33b), surpassing the record high RMB15.5b (US$2.39b) in the first quarter.

OOIL, meanwhile, reported a revenue increase of 119% YoY and 15% quarter-on-quarter to a new quarterly high of US$3.5b driven by increases in the average freight rates.

“We expect a positive reaction to COSCO's positive profit alert and OOIL's operational update with record-high quarterly revenue and net profit,” Jefferies said in a report.

“In fact, with spot rates continuing to hit new weekly all-time highs – and our expectation that this will continue in the near term – 3Q21 should be another record quarter.”

Jefferies forecast that container freight rates will continue to inch up on the back of supply bottlenecks with port congestion in Europe and the US that will likely worsen due to the recent Yantian port closure.

Yantian is now back to 85% operations, but with congestion of 3 to 4 days at South China ports.

Advertise

Advertise