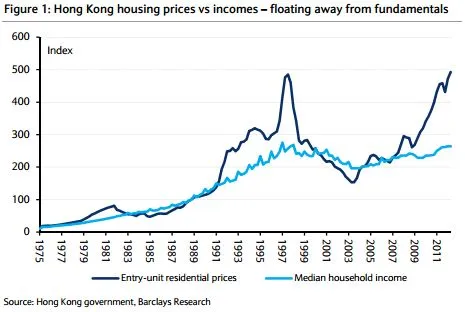

This graph shows housing prices vs household incomes in Hong Kong

When money is this cheap there is always trouble down the line.

Here's more from Barclays:

The unintended consequence of the HKMA’s mortgage lending measures is a more extreme cycle, dominated by property investors that think of their properties as liquid investments. This will ultimately lead to greater house price volatility. For investors, a ‘Minsky meltdown moment’ is now the most important asset in Hong Kong developers’ balance sheets.

Hong Kong’s US$-pegged, floating-rate mortgage market is increasingly resembling the adjustable-rate teaser mortgages of the US housing bubble.

Exceptionally low US$ interest rates and the uncertainty of any rate-adjustment timing – the ‘low for longer’ view – compounded by the underpricing of risk in mortgage lending by Hong Kong banks, in our view, has encouraged property investment and the hoarding of housing.

Simply put, when money is this cheap there is always trouble down the line.

Advertise

Advertise