Three Hong Kong IPOs fall apart in one week

Three IPOs in Hong Kong that were to have been launched last week have been shelved.

Graff Diamonds Corporation joins car dealer China Yongda Automobiles Services Holdings and copper producer China Nonferrous Mining Corporation as the latest victims of the rapidly cooling market demand for IPOs. Analysts said they expect more IPOs to collapse in Hong Kong and throughout Asia due to the extreme volatility sparked by the Eurozone crisis.

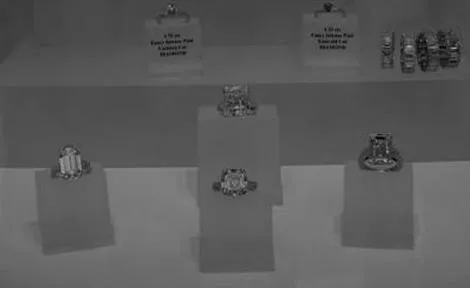

British jeweler Graff Diamonds intended to raise US$1 billion from an IPO that should have gotten off the ground last week. It is the biggest IPO deal to be pulled in Asia so far this year.

The London-based jeweler announced on May 31 that it decided to put off its IPO due to adverse market conditions. “Consistently declining stock markets proved to be a significant barrier to executing the transaction at this time,” the company said.

China Yongda decided to shelve its plan to raise up to US$433 million with an IPO on May 30 due to market volatility. China Nonferrous pulled its planned Hong Kong IPO offering of up to US$313 million on May 30 because of worsening market conditions.

Hong Kong’s main stock index, the Hang Seng, capped its fourth straight week of losses by closing at 18558.34 on June 1, the longest such losing streak since November 2011.

Dealmakers said investors were unnerved by the Eurozone crisis and the fact that global stocks fell 10% during the month. Some 46 companies have withdrawn or postponed IPOs worth a total US$7.7 billion in Asia thus far this year, according to Thomson Reuters.

Hong Kong, the world’s biggest IPO centre in 2010 and 2011, has dropped to fourth place this year after NASDAQ, New York and Shenzhen. Hong Kong listings have amounted to US$3.2 billion this year compared to US$35 billion for the whole of 2011.

Advertise

Advertise