Hong Kong's card payments market poised for 12.2% growth in 2024

The local card payments market will be worth $1.3t by year-end.

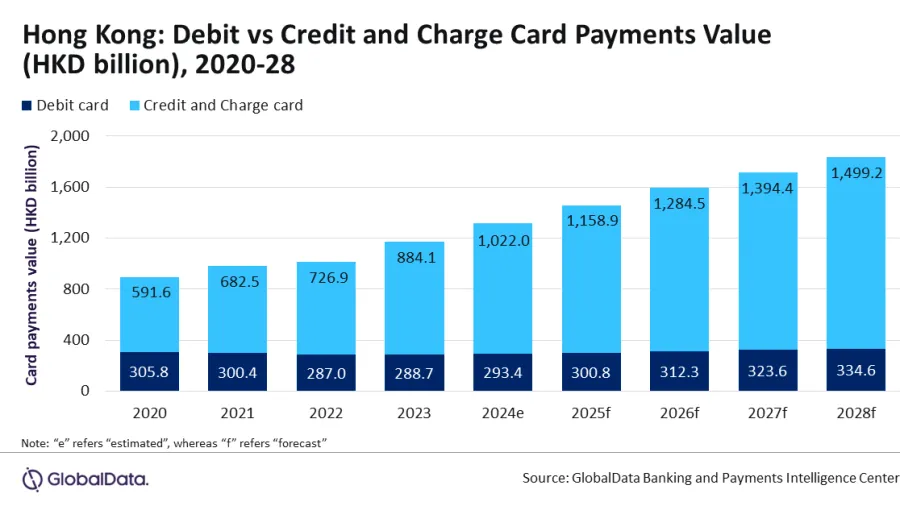

Consumers continuously embracing non-cash payments is anticipated to propel growth in Hong Kong’s card payments market, forecasted to increase by 12.2% in 2024.

Within the year, GlobalData expects the Hong Kong card payments market to be worth $1.3t. In 2023, the market grew 15.7% to reach $1.2t.

GlobalData also attributed Hong Kong’s card payment growth to its "well-developed payment infrastructure."

The city boasts a POS terminal penetration of 26,579 per 1 million individuals in 2023, surpassing markets such as Malaysia (26,228), China (25,513), Japan (20,867), and Thailand (16,358).

GlobalData reported credit and charge cards as the most popular, making up 75.4% of total card payments in 2023.

Debit cards account for the remaining 24.6% share.

“Hong Kong’s payment card market is expected to continue its upward growth trajectory, supported by widespread payment infrastructure and the increased convenience of contactless technology. The market is expected to grow at a CAGR of 8.7% between 2024 and 2028 to reach HKD1.8 trillion ($234.3 billion) in 2028,” GlboalData said.

Advertise

Advertise