Hong Kong banks poised for mild earnings growth in 2013

Margins will trend lower as yields fall further.

Persistent capital inflows and abundant system liquidity will benefit funding costs, said Barclays Capital However, margins will trend lower (-4bps in FY13E) as loan yields fall further owing to weak loan demand and fierce pricing competition, it added.

"We see slowing corporate credit growth and contraction of mortgage books by 5%, and lower our loan growth estimates to 6-7% in FY13-14E (from 7-8% previously). On the bright side, we expect a potential rise in credit costs to be delayed as borrowing costs remain low. We forecast underlying PPOP will rise by 4-8% y/y in FY13-14E, noted Barclays Capital.

Here's more from Barclays Capital:

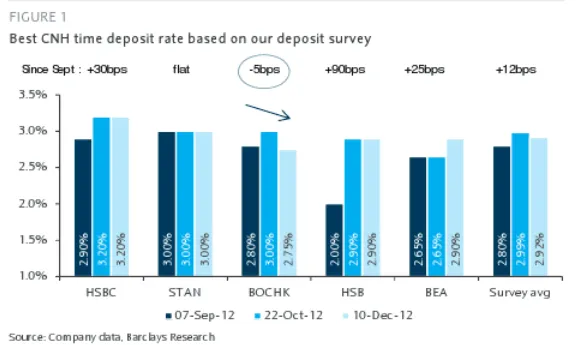

Liquidity is abundant and pricing competition is intense, but credit costs could stay low for longer in the current low interest rate environment. We prefer high dividend- yielding stocks, namely HSBC (OW) and BOCHK (upgraded to OW from EW, on lower offshore RMB (CNH) funding costs since October). We downgrade BEA to UW (from EW) due to its current excessive premium for potential corporate action. We adjust our price targets by +10.5% on average.

Stabilizing CNH funding costs, upgrade BOCHK to OW (from EW): CNH funding costs have risen sharply since June, and we believe are fully priced in given BOCHK’s 13% underperformance relative to the HSI over the past three months. Since September, CNH time deposit rates have stabilized, while investment securities and interbank yields have risen. In addition, BOCHK has an attractive dividend yield (5.6% FY13E) and is best capitalized (13% core Tier 1) of peers. Moreover, we believe persistent capital inflows into HK$ have reduced the threat to HK$ liquidity of growth in offshore RMB business.

Advertise

Advertise