Paul Chan outlines Hong Kong's role in developing Belt and Road economies

He has met with officials in Saudi Arabia, witnessed various MoUs, and delivered a speech at the FII.

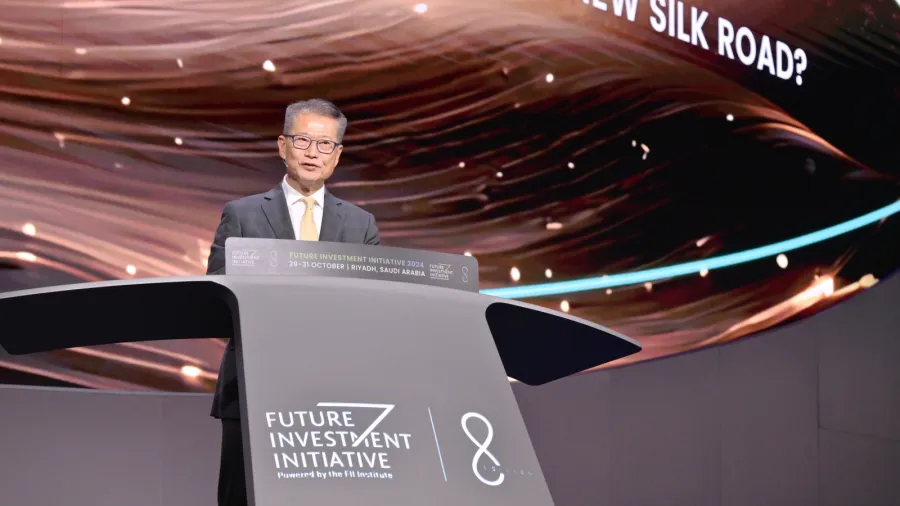

Paul Chan, financial secretary of the Hong Kong Special Administrative Region (HKSAR) government, shared Hong Kong has actively participated in and benefited from the Belt and Road Initiative, also known as the New Silk Road.

Chan said this during his visit to the Middle East where he witnessed the signing of various bilateral memoranda of understanding (MoUs) and delivered a speech at the "Future Investment Initiative" (FII).

Chan emphasised Hong Kong's ability to bridge funding, technology, and knowledge gaps to support sustainable development in Belt and Road economies.

"Our external trade with Belt and Road economies has increased by around 60%," said Chan, adding that Hong Kong's vision to become an international green tech and green finance centre can contribute to this achievement.

"First, we can address the funding gap. Hong Kong, as one of the top three international financial centres, along with New York and London, and Asia's green finance leader, is well positioned to mobilise capital to support the green transition by matching quality projects with funding,” he added.

He also talked about addressing the technology gap, reiterating that Hong Kong is home to many green tech start-ups that develop technological solutions to combat climate change, which may fit in the strategies of economies in the Middle East and North Africa (MENA) region.

"We can address the knowledge gap. That means linking up people, projects and knowledge. Hong Kong is a compact city yet has solid experience in city planning and operations and managing large-scale infrastructure projects," Chan said.

Whilst attending the FII, Chan also witnessed the signing of cooperation agreements between a number of Hong Kong organisations and enterprises with their counterparts in Saudi Arabia.

These included an MoU between the Hong Kong Monetary Authority (HKMA) and the Saudi Arabia Public Investment Fund (PIF) to jointly establish a new investment fund of up to $7.8b (US$1b).

The fund will invest in sectors such as manufacturing, renewables, fintech, and healthcare, promoting the development of enterprises from Hong Kong and the Guangdong-Hong Kong-Macao Greater Bay Area in Saudi Arabia, while strengthening Hong Kong's position as an international financial centre.

Chan also attended the listing ceremony of the SAB Invest Hang Seng Hong Kong Exchange Traded Fund at the Saudi Exchange.

Developed in collaboration with Saudi Awwal Bank's subsidiary, SAB Invest, this product provides Middle East investors with opportunities to invest in Hong Kong's capital markets.

($1 = US$0.13)

Advertise

Advertise