Financing Hong Kong’s future through social impact bonds (Part I)

By Andrew SennettThis is the first in a series of articles about this topic, social impact bonds. Check back with Hong Kong Business magazine for future updates and information.

Part I – An Introduction to Social Impact Bonds

There are few periods in economic and political history where markets have simultaneously faced such formidable challenges and encouraging trends as they do today. Failed credit markets, high unemployment rates, and an uncertain economy have placed government budgets under unprecedented pressure. Governments of all types are suffering from severe structural and long-term budget gaps – Hong Kong is no exception. In many cases, costly safety-net spending has crowded out prevention funding.

All of these challenges are compounded by extreme market failures in nonprofit organization (“NPO”) funding. Today’s social sector funding and structure have become so fragmented that even the most effective nonprofit providers are starved for growth capital. Traditional philanthropy and government alone can no longer solve the intractable social challenges facing Hong Kong and cities around the world.

Fortunately, burgeoning social innovation and a growing demand for impact investments are leading a new wave of financial optimism. Today’s youngest generations are filled with talent that is focused on achieving social impact. Despite the limited supply of impact investment products available today, the impact investing community continues to grow.

Still, there is work to be done to ensure that this new asset class reaches its full potential. There is a need for robust investment propositions where risks, as well as financial and social returns, are properly articulated and managed. It has also long been the case that growth-ready nonprofits suffer from poor access to capital markets.

There is today, however, a new financial instrument that can mobilize investment capital and drive social change in Hong Kong – the social impact bond (“SIB”).

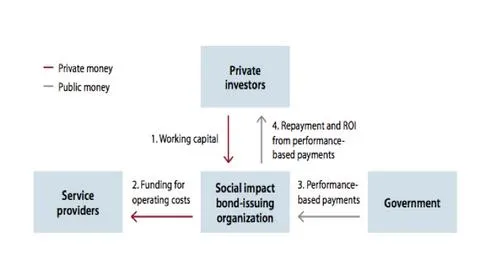

SIBs (sometimes referred to as pay-for-success bonds) create innovative new partnerships between public, private, and nonprofit entities. Employing private investment capital, SIBs distribute money to nonprofit groups that specialize in preventative social programs. If these programs achieve predefined metrics, the government pays investors their principal and a rate of return. (See Figure 1.)

By providing social entrepreneurs with the same access to funding as businesses, SIBs successfully align capital markets with the social sector. Overtime, SIBs could systematically change how foundations, pension funds, private investors, and the government deal with social issues.

Successful SIBs provide potential benefits to all of the parties involved and hold certain advantages over traditional forms of financing. For investors, SIBs offer a new and uncorrelated asset class with transparent risks, as well as promising social and financial returns.

The nonprofit providers also benefit from stable and predictable growth capital. And perhaps most important, Hong Kong communities will be provided with substantially improved social goods and services.

Additionally, because of their pay-for-success structure, SIBs are risk-free for the government and reduce public sector costs by decreasing remediation expenditures. As stated in Social Finance’s firm overview, a pioneer in SIB structuring, SIBs monetize social outcomes by capturing the value between prevention and these future expenses.

At their core, the financial engine of SIBs is future recoverable government savings as a result of investing in prevention. Funding SIBs will test Benjamin Franklin’s hypothesis that “an ounce of prevention is worth a pound of cure.”

Current approaches to government funding of social services create significant barriers to innovation. According to Jeffrey Liebman at Harvard University’s Kennedy School, and a leader in social finance, traditional funding streams tend to emphasize inputs rather than program objectives and are often overly prescriptive.

Often times, if outcomes are not rigorously assessed, unsuccessful initiatives can persist for years. For example, there are more than 1,000 chronically homeless individuals in Hong Kong and the government spends millions of dollars per year for emergency housing and medical care for this population.

These expenses are great, yet they don’t address the root problem of homelessness. Liebman notes that normally, the proof-of-concept process for social innovations is painstakingly slow. SIBs, however, break down such barriers. SIBs provide a solution because the scaling up of a program model occurs simultaneously with rigorous evaluation of its impacts, greatly speeding up expansion of successful programs.

Additionally, the SIB model uses private financing to overcome existing barriers to traditional performance-based pay for social service providers. Today, most providers would be hard pressed to secure sufficient capital to provide services up front and receive payments later; and, most would be unable to absorb the risk of not meeting specified performance thresholds. SIBs solve both of these dilemmas.

Government leaders around the world have already pegged SIBs as a new way to finance the future. The United States government has commented on SIBs saying, “As part of this Administration’s [Obama] commitment to using taxpayer dollars effectively, we are employing innovative new strategies to help ensure that the essential services of government produce their intended outcomes.”

Hong Kong should follow suit. While Hong Kong is domestically reviewing the SIB structure, it has yet to launch a finance vehicle of this type. Now more than ever, government programs must be measurably effective and designed to do more with fewer resources.

For too long, the government has funded programs based upon metrics that tell how many people it serves, but little about how it improves their lives. SIBs are the answer to this issue.

As a new financial apparatus, there remain many unanswered questions about the SIB model. But given the potential benefits of more rapidly addressing Hong Kong’s most pressing social problems, testing SIB models must be a priority. Initially, more money should be appropriated for pilot programs and for making the government more capable to adopt and establish SIB contracts. Overtime, SIBs should become a larger focus of the government budget as a way of financing for the future.

There also needs to be an increased focus on determining metrics that properly correlate to a program’s success, so they may be applied to a broader range of social efforts. In the end, SIBs will prove to be a promising new financial model that accelerates social innovation and improves government performance.

Advertise

Advertise