This Ginza-type commercial hub earns $2.4M a month despite non-strategic location

But it could have been earning 20% more if located in the main streets of Causeway Bay.

Here's from Colliers Internation

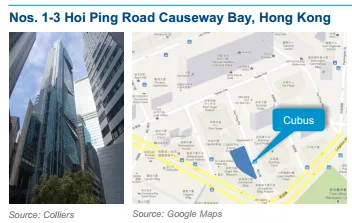

Completed in 2010, Cubus is a Ginza-type commercial building located close to the commercial and retail hub of Causeway Bay. Although the development is situated at one of the side-streets (i.e. Hoi Ping Road) in the district, it is right next to The Lee Gardens – a landmark building in Causeway Bay. Due to the increasing popularity of vertical retailing, the 22 retail floor-building has been fully leased to tenants engaged primarily in food and beverages, advertising/media and semi-retailing. Post Production Office Limited, a media company, currently occupies four levels on the high-floor zone.

In November 2012, the entire development was acquired by an insurance fund from Taiwan for a total consideration of HK$1.5 billion for long-term investment purpose. Current market yield is estimated at about 2.4%.

Notwithstanding the fact that Cubus is not located at a main street in Causeway Bay, the development has been enjoying sustained growth of vertical retailing in the sub-market primarily due to the continued growth of retail sales and the increase in footfall shortly after the opening of Hysan Place in August 2012.

The sales transaction of Cubus reflects strong investment demand on the back of continued expansion of Causeway Bay’s retail catchment as well as the solid demand for vertical retailing premises from a range of semi-retailing occupiers.

On the pricing front, the market yield of Cubus (i.e. 2.4%) is in line with the overall market average on Hong Kong Island. By valuation, achievable prices of other similar Ginza-type developments located at the main streets of Causeway Bay will be about 20% higher. It is also our observation that there has been robust buying interests in Causeway Bay from Southeast Asia monies as illustrated in the sale of 110 serviced apartment units at Shama Causeway Bay to a Thailand-based investor, and the acquisition of Bigfoot Centre at Yiu Wah Street by a buyer from Macau.

Advertise

Advertise