Patent box incentive boosts R&D investment in Hong Kong

New tax regime can attract R&D-focused businesses.

Hong Kong's new patent box tax incentive, which offers a 5% tax rate for intellectual property (IP) income, is expected to significantly boost research and development (R&D) investment in the region. Carol Lam, Director and Head of Tax at BDO, explains the potential impact and challenges of this initiative.

"The introduction of the Patent Box regime is a policy tool of the Hong Kong SAR government to encourage businesses to engage in more R&D activities and to promote Hong Kong as a regional IP trading hub," Lam said.

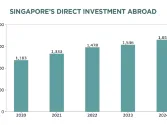

The new tax regime reduces the tax rate from 16.5% to 5%, making it competitive with other jurisdictions in the region. "For example, Singapore's tax rate is five or 10% where the 5% rate is subject to certain economic commitments, but Hong Kong does not have such requirements," Lam noted.

One of the competitive features of Hong Kong's patent box regime is that the eligible income includes IP income in sales, products, and services. This broad scope positions Hong Kong as a more attractive destination for R&D investment. "This new regime has managed to position Hong Kong on a more level playing field, if not maybe more competitive when it comes to attracting R&D investment," Lam emphasised.

Regarding the expected impacts on R&D spending, Lam explained that the tax incentive is designed to encourage increased R&D expenditure. "Under the legislation, the amount of profit eligible for the concessionary tax rate is determined based on the OECD's approach," she said.

This method incentivizes businesses to increase their R&D spending, aligning with the region's goal of becoming an innovation hub. One major issue in implementing the new tax regime is the local registration requirement for patents, which can be a lengthy process.

"One possible challenge is the patent registration process will take a long time," Lam pointed out. Although taxpayers can enjoy tax benefits for patents under application, these benefits will be withdrawn if the application does not result in a grant. "The government should consider putting more resources to speed up the patent filing process," she suggested.

Another concern is the potential neutralisation of tax benefits with the implementation of the global minimum tax under the OECD's Pillar Two initiative. "It is the Hong Kong SAR government's plan to implement a domestic minimum tax of 15% starting from 2025," Lam explained. Multinational enterprises subject to this minimum tax may not benefit from the new regime, as they would still need to pay a 15% tax in Hong Kong.

Advertise

Advertise

Commentary

2026 biotech playbook: Hong Kong at the centre of China’s globalisation

Navigating Hong Kong’s regulatory landscape: a challenging and rewarding endeavour

Wellness craze: Emerging growth for commercial space