Large-scale retailers take advantage of Hong Kong's prime office shopping boom

Recent woes in the retail sector made landlords increasingly open to different concepts.

Real estate services firm JLL noted that there were more leasing commitments for stores over 10,000 sq ft. in the first half of the year, suggesting that space-starved retailers are actively embarking on aggressive expansion plans.

New stores included the Decathlon store at Sheung Tak Plaza, which spans more than 72,000 sq ft with a 36,000 sq ft outdoor playground; Don Don Donki, which opened a 30,000 sq ft supermarket in Tsimshatsui and plans to lease another 50,000 sq ft at the soon-to-open OP Mall in Tsuen Wan; and toy brick company LEGO, who leased 20,000 sq ft. at K11 Musea in Tsimshatsui for the LEGOLAND Discovery Center.

Also read: 2.5 million sqft of retail space to be completed in 2019

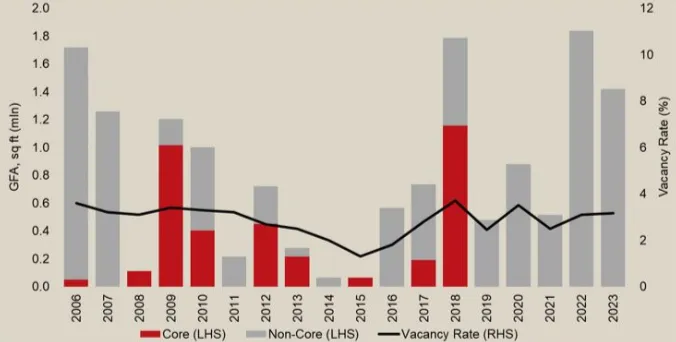

Pricey Hong Kong has seen fewer large store openings in recent years due to limited opportunities for retailers as occupancy rates in prime shopping centres remained above 95%, according to Nancy Wong, Assistant Manager for JLL’s research team.

Also read: Hong Kong retail sales to dip 5% in 2019: PwC

However, with 5.1 million sq ft of prime shopping centre space expected to come online over the next five years, larger-store retailers can look forward to new opportunities for expansion..

The supply of shopping malls scheduled for completion by 2019 marks one of the highest since 2006, according to an earlier report from Savills. This includes the widely anticipated K11 MUSEA in Tsim Sha Tsui which is expected to open in Q3.

Advertise

Advertise