Billionaires’ wealth in HK, Mainland China drops by 16.8% to $14t

The number of billionaires also declined to 501 from 588.

Billionaires’ wealth from Hong Kong SAR and Mainland China fell by 16.8% to $14t (US$1.8t), whilst the number dropped to 501 from 588, according to UBS’s 10th UBS Billionaire Ambitions Report.

The report noted that in a market with a high rate of billionaire churn, 138 people’s wealth fell below a billion, whilst 53 individuals became billionaires.

Indian billionaires’ wealth increased 42.1% to $7t (US$905.6b), whilst their number grew to 185 from 153.

Forty people became billionaires against the backdrop of rising equity prices and rapid economic expansion.

Moreover, growth in billionaire wealth in the region increased by 1.8% to $29.6t (US$3.8t); however, the number of billionaires fell to 981 from 1,019.

Aside from this, the report also highlighted how the year’s new billionaires were mainly self-made. People becoming billionaires for the first time numbered 268, with 60% of them entrepreneurs.

This reverses the position in last year’s report when most new billionaires were multi-generational billionaires inheriting money.

“As the great wealth transition gains momentum, the proportion of multigenerational billionaires is forecasted to increase,” the report noted.

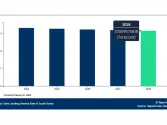

Between 2015 and 2024, total billionaire wealth increased by 121% globally to $108.9t (US$14t).

The tech billionaires’ wealth is growing the fastest of any sector, tripling from $6.14t (US$788.9b) in 2015 to $18.7t (US$2.4t) in 2024.

Industrial billionaires increased their wealth to $10.1t (US$1.3t) as nations invested in the green economy to deal with demographic challenges and to support the economic trend of reshoring.

In the 10 years of the report, multigenerational billionaires have inherited a total of 10.1t (US$1.3t), understating the total inheritance as many heirs have not themselves become billionaires.

Looking forward, the report noted that billionaires aged 70 or more will transfer $49 (US$6.3t) over the next 15 years, mainly to families but also to chosen causes.

That is a significant increase from 2023’s estimate of $40.5t (US$5.2t) over 20 to 30 years, due to asset price inflation and the ageing of billionaires.

($1 = US$13)

Advertise

Advertise