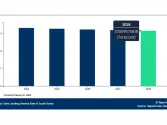

Approved mortgage loans down 5.6% to $37.3b in April

However, the number of mortgage applications rose to 14,898.

Mortgage loans approved in April fell 5.6% MoM to $37.3b, the Hong Kong Monetary Authority said in a statement, even as home prices rose for the 25th consecutive month.

Mortgage loans financing primary market transactions dropped 15% to $6.5b whilst those for secondary market transactions fell 5.7% to $20.8b. Those for refinancing went up 1.9% to 10b.

Also read: Steeper mortgages may loom as HIBOR extends climb to 1.32%

Mortgage loans drawn down during the month decreased 11.3% to $26.4b. However, the number of mortgage applications in April increased 8.6% MoM to 14,898 amidst skyrocketing property prices in the world’s least affordable housing market.

Also read: First time homebuyers rush to lock in home purchases before prices rise further

The median price of residential units in Hong Kong clocked in at around $6.19m in Q3, representing 19.4 times of the annual median income of $319,000 earned by local families. In other words, it takes a family on that income level as long as 19.4 years just to acquire a property.

Advertise

Advertise