Hong Kong sign tax pact with New Zealand

The agreement is the 17th aimed for the avoidance of double taxation in Hong Kong by its trading partners.

Hong Kong has signed an agreement with New Zealand for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income.

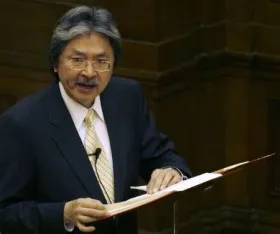

Financial Secretary John Tsang on Tuesday signed the agreement in Auckland with New Zealand’s Deputy Prime Minister and Minister of Finance Bill English.

This is the 17th comprehensive agreement for the avoidance of double taxation Hong Kong has concluded with its trading partners.

Mr Tsang welcomed the agreement as further strengthening the bilateral relationship by encouraging the flow of investment and talent between Hong Kong and New Zealand, according to a Ministry of Finance report.

Under the agreement, any New Zealand tax Hong Kong companies pay for profits from doing business through a permanent establishment in New Zealand will be allowed as a credit against the tax payable in Hong Kong in respect of the income, subject to the provisions of the tax laws of Hong Kong.

Upon coming into force, the agreement will supersede the existing limited double taxation avoidance agreement for airline income, providing the same level of benefit. The level of benefit in the existing reciprocal exemption on shipping income will also remain the same.

Advertise

Advertise