Hong Kong amongst the last to recover from COVID-19: analyst

The region will likely go back to its pre-COVID levels by Q1 2021.

Hong Kong’s economy is slated to be amongst the last to recover in Asia excluding Japan (AxJ) from the effects of the COVID-19 pandemic, according to a Morgan Stanley report. Joining the city are Singapore, Thailand and Malaysia.

Morgan Stanley’s economist Deyi Tan noted that, as one of the most export-oriented markets in AxJ, its lockdown measures have led to a double hit on exports and domestic demand. “Swings in trade tend to be high-beta relative to global nominal GDP and will lead to greater growth volatility for the more export-oriented economies,” said Tan.

In addition, Hong Kong and Singapore have some of the more aggressive fiscal policy responses in AxJ, but will likely be partly offset by the low fiscal multiplier amidst the uncertain environment and the sizeable drag from external demand

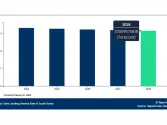

Overall, these markets are expected to fully recover by Q1 2021. Comparing Hong Kong to the rest of AxJ, China is tipped to recover the fastest, followed by the Philippines, Indonesia, India, Korea and Taiwan.

The report looked at three factors to a market’s recovery: its exposure to the global recession, the institutional response to handle the pandemic situation and the ramifications on domestic demand, and the room and willingness to undertake policy easing.

“Our assumption that daily COVID-19 cases will peak in AxJ sometime in Q2 and there is a gradual re-opening of economies implies that Q2 likely marks the worst quarter for most parts of AxJ (except China where Q1 was the worst), and we expect to see a growth turnaround in H2,” Tan stated.

Further, consolidated fiscal deficit in AxJ is also expected to widen from -7.8% of GDP in 2019 to -10.8% of GDP in 2020, driven by Hong Kong, Singapore, India, Indonesia and China. Tan stated that with this level, the fiscal deficit would be wider than the -10.3% of GDP seen during the 2009 Global Financial Crisis (GFC).

But Tan also said that this is still “manageable”. The starting point of fiscal deficit is also manageable, as most AxJ economies, including Singapore, are running deficits no more than -3.5% of GDP in 2019. Additionally, the current account surplus seen in most parts of AxJ also means there is domestic savings surplus to fund widening fiscal deficits.

“In our view, economies such as Singapore, Hong Kong, Taiwan and Korea likely have the most room for more fiscal easing,” he added.

Overall, Tan is projecting a V-shaped recovery as the need to allow economic activities to resume means a new normal of social distancing will likely remain in place until a vaccine against the virus comes. “This will likely constrain the pace of recovery,” Tan concluded.

Advertise

Advertise