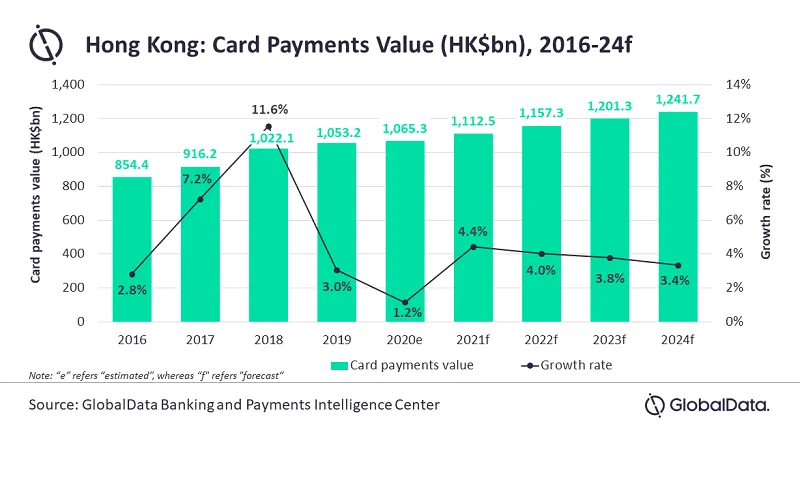

Hong Kong card payments to grow 1.2% in 2020

Fourth wave of infections to further erode consumer confidence in the near term.

Card payments in Hong Kong is estimated to register a subdued 1.2% growth in 2020, with expansion dented by lockdowns and social distancing measures resulting from the pandemic, reports data and analytics company GlobalData.

Hong Kong is currently facing a fourth wave of infections in the past few weeks. Commenting on the city’s latest retail statistics—in which Hong Kong registered an 8.8% YoY decline in retail sales compared to October 2019—a government spokesperson expects the new wave of infections to deteriorate consumer confidence in the near term.

“The global trade war followed by Hong Kong protests (also known as anti-extradition law movement) affected the country’s economy, a situation which further worsened by the COVID-19 crisis. The downturn in economic growth has affected consumers’ buying capacity and subsequently impacted card payment,” commented Nikhil Reddy, banking and payments analyst at GlobalData.

On the upside, Hong Kong’s card payments market is expected to revive in the coming months with gradual reopening of businesses, easing of travel restrictions and potential launch of a COVID-19 vaccine. Following this, the value of card payments is expected to increase at a compound annual growth rate of 3.9% between 2020 and 2024 to reach HK$1.24b (US$159.4b) in 2024.

Credit cards is the most affected of all the card types. According to the Hong Kong Monetary Authority, credit card transactions registered an 11% decline in Q1 compared to Q4 2019.

On the other hand, debit cards saw marginal rise of 0.9% during the same period.

Meanwhile, a rise in contactless card payments has been observed by GlobalData’s latest study on payments. To encourage contactless payments, the government introduced subsidy scheme for merchants in October 2020. Under this scheme, a subsidy of HK$5,000 (US$641.93) is offered to merchants to cover the cost of setting up contactless terminals and maintenance fees.

“Hong Kong has a well-developed card payment market and strong payment infrastructure. Whilst the current COVID-19 has caused a slowdown in its growth in 2020, it simultaneously brought major change in consumer preference towards non-cash tools such as contactless cards, which will in turn support card payments growth over the next few years,” Reddy concluded.

Advertise

Advertise