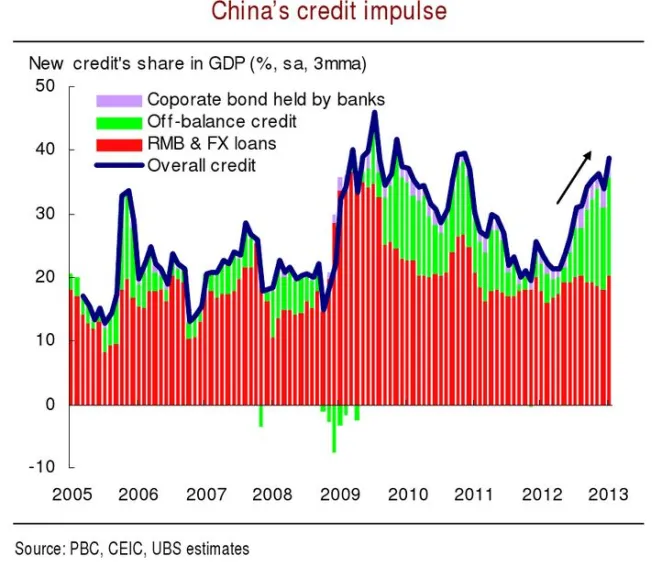

This is the most important chart on China: UBS

It holds the answer to the biggest economic questions.

According to UBS Securities Asia, when it comes to gauging China’s current economic condition, policy direction and risks, the chart on the right can say so much.

The firm considers this the most important chart on China at the moment, and it depicts the movement of estimated credit impulse – monthly new credit extended predominantly by banks, seasonally adjusted, relative to estimated GDP.

Here's more from UBS Securities Asia:

We used to focus on new RMB lending, but now incorporate other types of credit, since the latter have developed rapidly and are the main sources of extra new credit, including banks’ bond purchase, off-balance sheet credit, and trust loans (a part of the overall trust assets).

Three things are immediately clear from the chart: (i) credit impulse has been strong since H2 2012, following a sharp slowdown in mid-2011; (ii) much of the action has come from credit outside of bank lending since mid-2012; and (iii) the momentum of credit impulse does not look sustainable beyond a few months at best, after which credit expansion impulse should weaken, even if only gradually.

This chart goes a long way to help us answer some of the most asked questions from investors: How can we be sure of the recovery? Look at the credit impulse since mid-2012. What has driven China’s recovery? Again, look at this chart: a strong credit expansion – the continued increase of leverage, which not only helped to turn some of those accounts receivables into more cash flows and relieve local governments’ financial stress, but also helped to finance new infrastructure investment and property related investment.

How long might the recovery last? We thought the momentum of credit expansion had peaked in September-October 2012, but after a brief pause, credit impulse continued to trend upward so far this year. Since credit leads construction and activity in general, this means that growth momentum could pick up further in Q1-Q2 2013, as long as exports do not collapse soon and the government does not tighten macro policy aggressively tomorrow.

The nature of the recent credit expansion – the fact that much of the extra expansion has come from non-loan credit – points to what we consider a high-probability risk to China’s economy this year: economic volatility led by liquidity tightening related to unwinding of some shadow banking activities.

The latter could be triggered by either the government starting to tighten regulations on shadow banking or clamping down on some irregular fund raising activities by local government platforms, or by a loss of confidence as a result of payment problems in some wealth management products or local government platforms.

In either case, the most likely scenario would be that banks are forced to move both the off-balance sheet assets (credit) and liabilities (WMPs, for example, which we did not include here to avoid double counting) on to their balance sheet. Without the formal lending quota being expanded proportionally, there will be a liquidity and credit tightening, much like what happened in mid 2011.

The chart can also help us understand where monetary and credit policy may be headed next. Given how strongly credit impulse has been and is still going, it is a matter of months, perhaps sooner rather than later, before the government start to rein in credit and tighten monetary conditions.

This could be done by either slowing down base money growth or tighter supervision or regulatory measures. Such a change in policy direction will likely be proceeded by a further pick up in fixed investment and in property activities, and a rebound in inflation. We think the chance of policy fine-tuning in April has increased, though H2 may still be the more likely timing.

Finally, to the extend the current recovery has been led by more credit and leverage and not by strong export or private demand or after a meaningful consolidation and restructuring at the corporate level, we think it could be relatively shallow, and corporate earnings growth will be mainly led by revenue growth rather than fundamentally improved profitability.

Advertise

Advertise