Moody's rates Malaysia's plan to shrink budget deficit as credit positive

In line with 2020 book-balancing targets.

Moody’s rated the ongoing budgetary consolidation of Malaysia as credit positive for the sovereign, following the Government of Malaysia’s recent introduction of its 2015 budget, which calls for a smaller fiscal deficit driven by expenditure cuts.

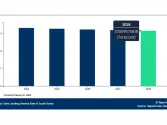

According to a research note from Moody’s, the administration’s projection of a federal government deficit of 3.0% of GDP in 2015, if realized, would mark a sixth consecutive year of narrowing fiscal gaps, following a stimulus-induced peak of 6.7% in 2009.

It is also in line with the government’s target to balance its books by 2020. We estimate that the federal government’s outstanding debt stock would fall for a second consecutive year to 51.7%, from a high of 54.7% of GDP in 2013.

The budget shows total expenditure declining to 22.8% of GDP in 2015, from 24.7% in the revised budget for 2014.

The primary driver will be cuts to subsidy outlays, which will fall to 16.9% of the federal government operating expenditure in 2015, the lowest share of current spending since 2010.

In local currency terms, the government expects subsidy costs to decrease 7.1% year on year. The lower subsidy bill incorporates a fuel price hike that became effective on 2 October, as well as a “more targeted” subsidy mechanism, which the administration will detail at a later date.

Here’s more from Moody’s:

However, the government also announced measures to cushion the effect of subsidy cuts and the implementation of a goods and services tax (GST) on consumers’ purchasing power. The overall effect will be a reduction in the total revenue to 19.8% of GDP next year from 21.1% this year, even with the 1 April 2015 introduction of the more efficient GST.

The government forecasts that GST receipts will comprise 9.2% of federal government revenue next year. By contrast, it projects receipts from the sales and services taxes that the GST replaces to amount to just 7.9% of revenue for 2014. The government designed the GST to enhance tax transparency and compliance.

The GST implementation also eases the government’s reliance on petroleum-related income. The budget projects petroleum income taxes, export taxes on crude oil, petroleum royalties and dividends from Petroliam Nasional Berhad (A1 stable) will comprise 25.6% of total revenue in 2015, down from 35.0% in 2011. In addition, the revenue diversification that GST provides mitigates risks to income related to oil price volatility.

The 2015 budget assumes an average Tapis crude oil price of $105 per barrel, compared to current prices of around $90, and versus our expectations for benchmark to remain below $100 per barrel next year.

Lower oil prices will further accelerate gains in reducing the subsidy bill.

Offsetting measures to preserve consumers’ purchasing power somewhat blunt the effectiveness of the subsidy reforms and the introduction of the GST because they lead to an erosion of revenue.

The government has expanded the list of items exempted from the tax to include many basic food items, medicines, electricity consumption beneath a certain threshold, and subsidized fuel. It also announced an expansion of benefits for lower-income households, and cut individual income tax rates starting in 2015. Moreover, corporate income tax rates will fall by one percentage point starting in 2016.

Advertise

Advertise