Moody's maintains stable outlook on Asian utilities

High levels of government ownership in the sector bolster ratings behind support from the government and strong access to the domestic capital and bank markets.

Moody's Investors Service is maintaining its stable outlook on the Asian (ex-Japan) utilities sector, in light of the region's solid economic growth, as well as the dominant and protected market positions of most of the rated companies in their individual countries.

The outlook also reflects the supportive regulatory regimes throughout the region, according to a Moody's report.

"These factors enhance sector stability and support steady and predictable cash flows," says Jennifer Wong, Moody's AVP-Analyst and author of the report.

Furthermore, the outlook reflects Moody's expectation that any necessary reform will be gradual, such that the impact on the credit profiles of the affected utilities will be minimal, as supply stability remains a crucial element supporting the ratings.

The sector is also characterized by high levels of government ownership, which provide rating support, given the resultant expectations of both support from the government and strong access to the domestic capital and bank markets.

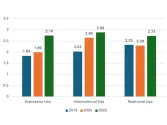

Moreover, the financial profiles of the rated utilities generally compare well against their global investment-grade peers, and despite their exposure to fuel cost volatility in the absence of an effective cost pass-through mechanism. Moody's rates bond debt issued by the region's utilities amounting to more than US$29.2 billion, with an estimated US$3.3 billion issued in 2010.

"The sector will have substantial funding requirements over the next few years, but we believe that this will be manageable as the high level of government ownership means that most of the Asian utilities have a significant amount of access to their domestic capital and bank markets," Wong adds.

Capital expenditures to expand generating capacity are already increasing, given the expectation of long-term growth in electricity demand. The expansion of nuclear power capacity is also on the rise, given the lack of domestic fuel sources and encouragement by governments concerned about pollution and climate change.

Moreover, aggressive expansion overseas will expand the utilities' risk profiles. These acquisitions tend to be capital-intensive; some remain in their early stages with regard to overall cash flow generation. Furthermore, some of these acquisitions may result in exposure to less transparent, unregulated, and less certain regulatory frameworks.

Advertise

Advertise