North Asia Strategic profit up 88 times to HK$11.34mln

NAS’s profit surges behind healthy growth of its three divisions in the half year period.

North Asia Strategic Holdings Limited (“NAS”, and its subsidiaries and jointly-controlled entities, collectively the “Group”) on Thursday announced its interim results for the six months ended 30th September 2010 (the “half year period”).

The Group recorded an unaudited consolidated revenue of approximately HK$1,733,694,000 for the half year period representing a growth of approximately 15.3% from the corresponding period last year. The Group’s unaudited consolidated net profit substantially increased 88 times from approximately HK$128,000 for the corresponding period last year to approximately HK$11,339,000 this year, according to a NAS report.

“We are continuing to see strengthening and stabilisation of customer demand and prices across our businesses during the last quarter. Coupled with management actions taken to grow sales, streamline operations and improve efficiency, three of the four business divisions had healthy growth in the half year period while the branded food division continued to narrow its operating loss per store by increasing the scale of operations,” said Chief Executive Officer John Saliling.

Core operating businesses

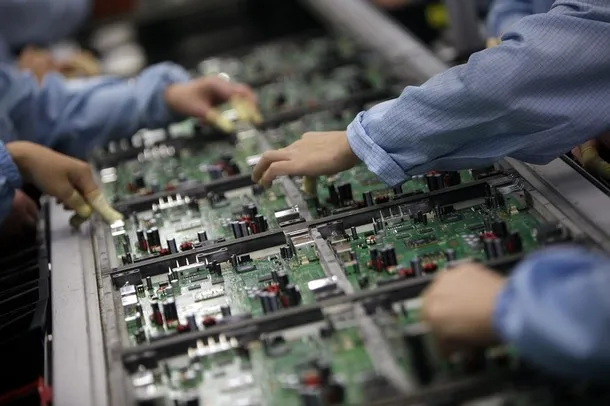

Hi-Tech Distribution and Services Division

With the sharp recovery in capital expenditure by both global and local electronics manufacturing companies, particularly in China, and management actions taken on sales and operational efficiency, revenue and net profit for the second quarter ended 30th September 2010 (the “second quarter”) increased by about 89.4% and 504.3% respectively compared to the preceding quarter. As a result, the division reported a record-high revenue of approximately HK$941,265,000 and a net profit of approximately HK$24,957,000 for the half year period, a significant growth over revenue of HK$309,405,000 and net profit of HK$5,446,000 over the corresponding period last year.

“Although increasing sales is a result of our dominant position in the market, we believe the second quarter’s increase in sales is exceptional, as a response to pent-up demand during the global downturn, and expect quarterly sales in the future to return to historical levels. Going forward, our management team is focused on further building on our extensive distribution and sales capability in China, Vietnam and India which serve majority of leading global manufacturers in the hi-tech industry,” said Mr Saliling.

Fishmeal and Seafood Product Division

For the fishmeal trading business, there was a seasonal fluctuation of the demand and pricing for brown fishmeal and feeds and the Group continues to manage pricing and demand by continuously monitoring market data and implementing smaller lot purchases. On the other hand, the Group’s fish oil business continued to grow in both domestic and export markets with stabilised demand and pricing. As a result, the Group reported shared revenue of approximately HK$224,111,000 with a higher net profit of approximately HK$15,580,000 during the half year period for its 40% jointly-controlled fishmeal and seafood product division conducted through Coland Group Limited. This compares with revenue of approximately HK$320,066,000 and a net profit of approximately HK$9,713,000 for the corresponding period last year.

Mr Saliling said, “Going forward, we foresee an encouraging rebound in demand for our fish oil products in both domestic and export markets but a seasonal decline of the demand for fishmeal and feeds in the near term due to cold weather. We will continue to take a well balanced approach in monitoring our trading operation and growing our processed product businesses.”

Chemical Operation Division

For the chemical operation division conducted through TKC, the Group shared 33.74% of its revenue of approximately HK$498,285,000 and net profit of approximately HK$29,193,000 in the half year period.

On 13th July 2010, the Group completed the disposal of the entire stake held by North Asia Strategic (Singapore) Pte. Ltd., a subsidiary of the Group, in TKC for a cash consideration of KRW77 billion (approximately HK$500.5 million as disclosed in the company’s circular dated 22nd June 2010). With the disposal of TKC completed, the turnover and earnings from TKC will no longer be included in the Group results.

Branded Food Division

During the second quarter, the Group operated 16 restaurants in Hong Kong, and closed one restaurant as its lease was expired. With the improved economy and wider presence in the Hong Kong market arising from the increased number of our restaurants and management actions taken to streamline operations and boost efficiency, the operating loss at restaurant level per restaurant was further reduced by approximately 26.7% in the second quarter compared to the preceding quarter. During the half year period, the branded food division recorded revenue of approximately HK$70,032,000. The Group continues to look for attractive locations to grow its business and accelerate improvement of our financial performance.

Outlook and strategy

The Group remains cautiously optimistic that the improving trend will be sustained but the Group will continue to manage the business prudently given continuing uncertainties in the global economy.

Mr Saliling concluded, “With the improved business outlook, the management teams continue to execute our business plan to augment organic growth which includes new businesses and products while also considering complementary acquisitions. We are also actively seeking investment targets in profitable middle-market companies with a positive cash-flow within other growth sectors in North Asia which have a unique and sustainable market position in their own industry that is potentially scalable either nationally or regionally. ”

Advertise

Advertise