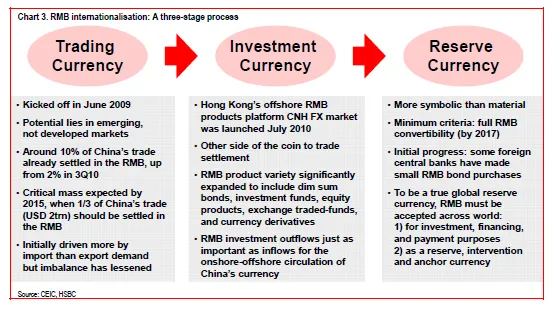

Infographic: 3-stage process in the global rise of China currency

RMB bank deposits in HK already more than six times the level in mid-2010.

According to HSBC, the global rise of China’s currency is best understood in three stages – its rise as a global trade settlement currency, followed by its acceptance as a leading investment currency and then its emergence as a reserve currency.

The first two stages go hand-in-hand as neither can reach critical mass without the other (see chart at the right corner).

Here's more from HSBC:

Merchandise trade settled in RMB has grown from around 2% of China’s total trade in mid- 2010 to around 10% today. Of that, Hong Kong handles about 90%, up from 60% in mid-2010 and 80% in mid-2011. With RMB trade settlement being a major source of RMB deposit growth, Hong Kong’s pool of offshore RMB deposits is by far the largest in the world.

Liquidity and transactions

As of end October, RMB bank deposits in Hong Kong stood at RMB555bn, more than six times the level in mid-2010. This has enabled the city’s

financial institutions and the Hong Kong Monetary Authority (HKMA) to establish a thriving offshore RMB market.

RMB liquidity22 is critical for nurturing transaction turnover in a young CNH market (the offshore RMB is generally known as the CNH). The bigger the pool of CNH liquidity the more viable the market becomes for institutional investors.

The healthy development of CNH business looks set to continue in the SAR. At over RMB680bn, total RMB liquidity remains at sufficient levels to accommodate healthy CNH transaction turnover in Hong Kong. And despite stalling global and regional trade, offshore RMB trade settlement is still growing strong. RMB deposit growth has slowed over the past year, in part because of slower mainland growth and tighter onshore liquidity conditions in China. But other structural, not cyclical, factors also contributed to this slowdown, including:

The moderation of RMB appreciation expectations since late 2011. This has helped to rectify the severe imbalance between RMB outflows and inflows (slanted heavily towards outflows from China throughout 2010-11).

The expansion and/or opening up of new channels for RMB inflows back to China (e.g., RMB QFII), plus the streamlining of these channels by regulators (e.g., RMB FDI).

The reallocation of RMB funds away from deposit accounts towards higher yielding CNH investment products, especially bonds and certificates of deposits.

We take this gradual structural shift as a good sign, as it indicates the market is maturing.

As China’s growth momentum strengthens and monetary conditions return to their long-term trend, we expect CNH liquidity growth to strengthen again.

We also expect the pool of offshore RMB liquidity in Hong Kong to top RMB 2.6trn by the end of 2015. By then, we expect the RMB to account for

about 30% of Hong Kong’s total deposits by the end of 2015, up from today’s 9%.

As offshore use of the RMB picks up pace our credit strategist expects gross issuance of dim sum bonds to total RMB280-360bn in 2013, up from RMB263 year-to-date in 2012.

Advertise

Advertise