Industrial property investment ballooned 76% in Q1 2019

1 in 3 deals focused on purchasing old industrial buildings for redevelopment.

Despite Q1 2019’s total transaction volumes representing just 46% of the quarterly average over the past three years, industrial real estate investment volume surged 76% QoQ, with a focus on purchasing older industrial buildings for redevelopment, according to CBRE’s industrial marketview.

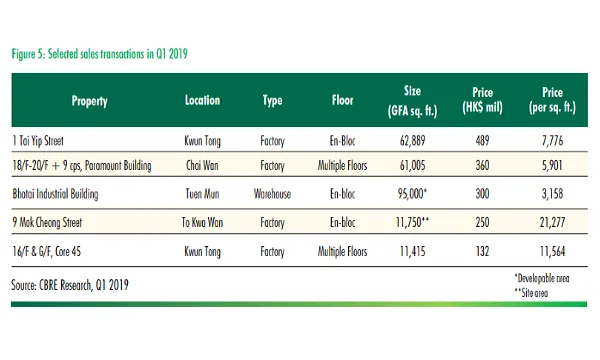

Such deals accounted for 34% of transaction volume during the quarter. The largest deal saw Hanison Construction purchase 1 Tai Yip Street in Kwun Tong for $489m or $7,776 psf to expand its investment portfolio.

Third-party logistics companies (3PLs) remained active in committing to new space in Q1 2019, such as Sun Hing Logistics’ lease of a 51,000 sqft space and Pantos Logistics’ lease of a 29,000 sqft unit in Hutchison Logistics Centre in Kwai Chung.

Elsewhere, CN Logistics leased a 46,000 sqft unit in Global Gateway in Tsuen Wan, whilst MOL Logistics was forced to relocate to a 59,000 sqft space in Asia Logistics Hub - SF Centre in Tsing Yi. It’s previous home at Ever Gain Centre No.3 in Shatin will be converted into an en-bloc data centre, CBRE revealed.

Meanwhile, warehouse vacancy inched up 0.3 percentage points (ppt) to 2.1%. Vacancy in ramp-access buildings was found to have compressed from 1.8% to 1.4%, but rose in cargo-lift access space from 1.9% to 3.2%.

“Lower vacancy in ramp access buildings ensured rents jumped 2.3% QoQ, the strongest growth since Q4 2013,” CBRE explained. Although the increase in cargo-lift warehouse vacancy resulted in slower rental growth of just 0.9% QoQ, overall warehouse rents still increased 1.8% QoQ, which is the strongest growth since Q4 2014.

The report noted that Kerry Logistics’ sale of its Kerry Warehouses in Chai Wan and Shatin to its parent company for redevelopment will result in the withdrawal of 967,000 sqft of cargo-lift access space from the market in short-to-medium term.

CBRE further added that the low availability of traditional warehouses has prompted some occupiers to consider leasing temporary warehouses on brownfield land in the New Territories.

3PLs are expected to adopt a wait-and-see approach before committing to any major expansions in 2019. However, demand from other sectors with less exposure to trade conflict, such as cold-chain related industries, e-commerce, data centres and self-storage, will be resilient.

“The outlook for the cold chain sector is especially positive, with Hong Kong International Airport recognised as the world’s first partner airport of the IATA’s Centre for Excellence for Perishable Logistics, underlining Hong Kong’s capacity to handle perishable products,” CBRE highlighted.

Additionally, new leasing activity is forecasted to be limited by low vacancy, with some occupiers facing aggressive renewal terms opting to relocate to the New Territories.

Details of the new industrial revitalisation policy announced in Q1 2019 indicated that under the new wholesale conversion scheme, the restriction of a 10% designated portion for specific use is likely to attract less applications.

“At the same time however, the relaxation of a 20% non-domestic plot ratio for the redevelopment of pre-1987 industrial buildings is likely to stimulate more en-bloc transactions and redevelopment,” CBRE said, adding that the 22 million sqft of industrial space expected to be removed from the market over the next five years could further boost forced relocation activity.

Advertise

Advertise