Hong Kong beats US and UK as preferred destination for Chinese property investment in 2018

The SAR snapped up 61% of investment volume for a record US$9.53b.

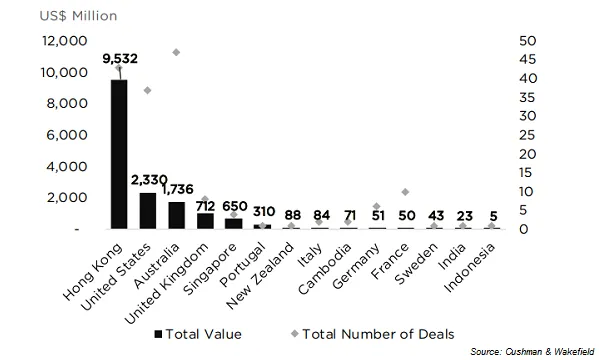

Hong Kong retained the crown as the top destination for Chinese real estate investment in 2018 for the second consecutive year after commanding 61% of investment volume or US$9.53b in deals, according to Cushman & Wakefield.

The SAR beat out the United States which saw US$2.33b in investment volume and Australia (US$1.74b). The United Kingdom and Singapore round out the top five after witnessing US$712m and US$650m in respective deals.

Also read: China's commercial property investment hits a record $43.8b in 2018

Hong Kong’s blockbuster deals include the US$1.91b sale of Cityplaza Three & Four; the US$1.27b sale of an office in 18 King Wah Road and the US$1.02b sale of Octa Tower. The acquisition of a 29.9% stake in Link REIT portfolio for US$881m by a consortium and the US$844m acquisition of a development site in Tuen Mun Town Lot #500 also made it to the top five biggest deals by Chinese investors into Hong Kong.

However, the subdued market environment and stricter rules on capital outflow in the Mainland has marked a shift in Chinese property investment towards disposal over acquisitions. In fact, investment volume into Hong Kong dropped 20% YoY in 2018.

In terms of investor sentiment, however, only 18% of Chinese real estate investors plan to invest into Hong Kong in 2019 compared to 35% in US and 24% the UK and Australia.

“We forecast that in the mid-term MCREIO investors will endeavor to stay on the sidelines with respect to investments in the U.S. or UK until political turmoil subsides,” C&W said in a report. “Investment into South Korea, Malaysia and Canada seems set to remain muted. Likewise, outside the UK and Germany, Europe will likely remain unpopular unless platform deals of logistics or quality Senior Care assets became available.”

Advertise

Advertise