Hong Kong is amongst APAC's most transparent real estate markets

It ranks 3rd in APAC and 13th globally.

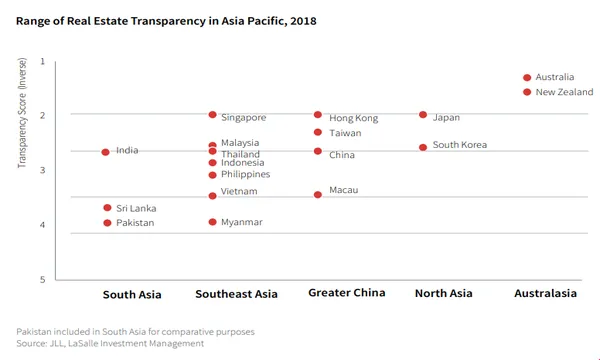

Hong Kong has tied with Singapore as the third most transparent real estate market in Asia Pacific with the SAR trailing closely behind Australia and New Zealand, according to real estate consultant JLL.

Transparency in the real estate sector can be measured through clear flow of information, robust property returns and metrics, strong legal and tax frameworks and efficient methods for investors to acquire, lease, manage and sell property assets.

“Transparency is critical to the operation of efficient markets,” said Richard Bloxom, global head of capital markets at JLL. “The industry is increasingly in the spotlight and transparency is a significant factor in enabling us to create healthy real estate markets.”

Hong Kong has a transparency score of 1.97, which makes it 13th most transparent globally and within the ‘transparent’ tier but falls short of the ‘highly transparent’ index. The United Kingdom snagged the global crown followed by Australia, US, France and Canada who are in the top tier.

The adoption of proptech could also boost Hong Kong through the transparency rankings, JLL noted, as the usage of open data and technology initiatives could open up the real estate sector to capture data and business intelligence through application of advanced analytics and algorithms.

Also read: Hong Kong and Mainland clinch 41% of global proptech investments

However, Hong Kong’s dominance may be put at risk as its status as one of the world’s wealthiest real estate markets alongside Miami, London and New York may lead to heightened vulnerability to sketchy organisations transferring illegal profits into legitimate real estate assets, JLL warned.

Similarly, China, Indonesia, Philippines, Macau, Thailand and India rank amongst the ‘semi-transparent’ markets as they still need to address issues of corporate governance and regulatory enforcement. Myanmar has also registered the largest improvement on a global scale whilst India’s reform-driven administration which includes amendments to the REIT regulation is pushing the transparency agenda forward. On the other end of the spectrum are Iraq, Senegal, Lebanon, Uganda and Libya are included in the ‘opaque’ tier as geopolitical and economic challenges hamper real estate transparency.

JLL’s transparency report which covers 100 countries and 158 city markets assess rankings based on six categories including performance measurement, market fundamentals, governance of listed vehicles, regulatory and legal frameworks, transaction process and sustainability.

Advertise

Advertise