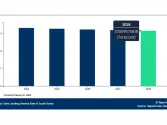

Commercial property investment drops 17.8% YoY in Q1: report

Investment volume fell to $6.59b.

Hong Kong’s investment volumes of commercial properties over $50m fell 17.8% year-on-year (YoY) to $6.59b (US$850m) in Q1, JLL reported.

Investment sentiment remained subdued as interest rates remained high, whilst transaction volumes were supported by distressed asset sales.

According to JLL, investors remained cautious and were generally searching for opportunities offering yields at at least 6%, as the cost of debt for core real estate financing stood at above 5%.

In APAC, commercial real estate (CRE) investment rose 20% YoY to US$36.3b, the highest first quarter level since the 2022 rate hike cycle.

“Despite the threat of tariffs, the region recorded a sixth quarter of YoY growth, with all property sectors except industrial & logistics experiencing higher investments,” JLL said.

"Looking forward, investment volumes are expected to remain at a relatively low level as investor sentiment would not improve significantly when the financing cost is higher than property return. However, interest rate cuts by the US Fed and China's stimulus package would likely raise investor confidence,” Oscar Chan, head of Capital Markets at JLL Hong Kong, said.

Advertise

Advertise