Grade A office vacancy drop 13.3%, rent slips 0.8% in October

Rents declined by 0.8%.

Grade A office vacancy rates across all five major business districts declined in October, JLL reported.

Overall vacancy rate in October dropped 13.3% with a positive net absorption recorded at 183,700 sq ft.

Notably, the vacancy rate in Wanchai/Causeway Bay decreased by 0.4 percentage points (pps) to below 10%, whilst the Central saw a similar decrease of 0.4 pps.

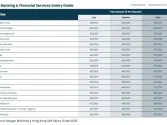

According to JLL, financial institutions are the most active tenants in the leasing market. There is also an increased interest from private wealth management firms and family offices.

Notable leasing transactions include Millennium Management’s lease of an entire floor of 23,900 sq ft (LFA) at Two International Finance Centre in Central for in-house expansion.

“Despite the economic challenges, leasing demand from family offices is expected to increase in the long term, as the government has launched initiatives to attract high-net-worth individuals to set up family offices in the city.” Alex Barnes, managing director at JLL in Hong Kong said.

On the flip side, the overall net effective rent continued to decline, dropping by 0.8% month-on-month (MoM).

Rents in Central decreased by 0.8%, whilst rents in the Wanchai / Causeway Bay and Hong Kong East submarkets fell by 0.5% and 1.1%, respectively.

Advertise

Advertise