Country Garden unveils debt restructuring deal to cut US$11.6b burden

The company has secured a maturity extension of up to 11.5 years from banks.

Country Garden Holdings Company has reached a restructuring proposal with its co-ordination committee, with the target of reducing its indebtedness by up to US$11.6b (approximately HK$90.26b).

The Hong Kong-based real estate company said that it has secured a maturity extension of up to 11.5 years, with a reduction in funding costs, with a targeted decrease in borrowing costs to 2% per annum post-restructuring from 6% previously.

This should result in the group having “a more sustainable capital structure”, allowing it to focus on building housing units, continuing business operations, and preserving its asset value, Country Garden said in an HKEX filing.

The plan also enables the company to have the means to implement a business and asset disposal strategy that has the best potential to maximise value for stakeholders

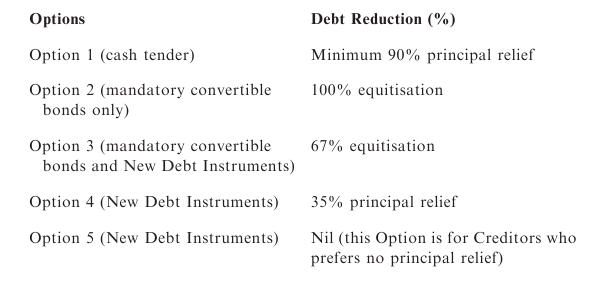

Approximate percentage of principal relief for the various options are as follows:

The committee consists of seven banks who control approximately 48% of three syndicated loans of the company, with a total principal amount of US$3.6b (HK$28.01b).

Separately, Country Garden Holdings said that it has been talking with its other offshore credits and their advisors. This includes meeting with holders who control approximately 30% of the outstanding principal amount of USD senior notes and HKD convertible notes it has issued, equal to US$10.3b of existing debt bonds.

(US$1 = HK$7.78; data from Refinitiv, as of 10 January 2025)

Advertise

Advertise