Hong Kong Insurance Authority

The Hong Kong Insurance Authority (IA) is an insurance regulator established under the Insurance Ordinance (Cap. 41). The principal function of IA is to regulate and supervise the insurance industry for the promotion of the general stability of the insurance industry and for the protection of existing and potential policy holders.

See below for the Latest Hong Kong Insurance Authority News, Analysis, Profit Results, Share Price Information, and Commentary.

Business premiums hit $637b as accident and health profit recovers

Business premiums hit $637b as accident and health profit recovers

Accident and health business returned to profit of $0.5b.

Hong Kong insurers pay $33.4m after Tai Po fire

For life insurance, residents of Wang Fuk Court hold about 10,660 policies.

Insurance premiums rise in Q2 amidst Mainland tourist influx: Jefferies

Premiums peaked at $90b as the city saw its highest tourist number since the pandemic.

Prudential keeps business plans steady after D-SII designation

The insurer said it remains strongly capitalised.

Hong Kong Insurance Authority urges joint effort in risk management

HKIA highlighted its ongoing collaboration with insurers and academics.

Bloomberg supports insurers with HKIA sustainable bond dataset

It helps insurers comply with sustainable investment requirements.

Hong Kong says captive insurance is a tool for Belt and Road projects

Lau also said the scale of the Belt and Road Initiative brings complex risks.

Hong Kong Insurance Authority sets 50% cap on broker referral fees

The HKIA warned that excessive referral fees could mask commission rebates.

HKIA launches AI cohort programme with seven insurers

A survey of more than 110 insurers showed 20% already have AI adoption strategies.

HKIA issues guidance on intermediary pay for long-term policies

The HKIA expects insurers to ensure intermediaries provide both pre-contract advice.

Hong Kong insurance premiums hit $28.6b in Q1 2025

This was driven by robust growth in both long-term and general insurance business.

HKIA and peers unveil Charter 3.0 to strengthen scam defence

It brings together financial regulators, technology and telecommunications companies.

Hong Kong’s insurance premiums reach $83b in 2024

Both long-term and general insurance sectors registered notable increases.

HKIA sets 6% illustration rate cap on HKD policies

Caps apply only to internal rate of return used in benefit illustrations at the point of sale.

FuSure Reinsurance obtains Composite License from Hong Kong

The company is also exploring health, auto, pet, cybersecurity, and liability insurance.

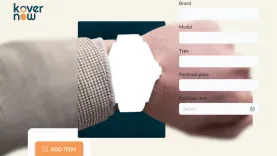

KoverNow gets greenlight from HKIA, launches app

It offers coverage for luxury goods and collectibles.

Hong Kong insurance premiums surge 12.2% in 9M 2024

The period already shows signs of a rebound from the 1.1% fall in 2023.

Advertise

Advertise

Commentary

Wellness craze: Emerging growth for commercial space