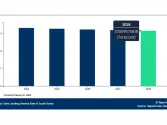

China’s export growth plummets to 7-month low of 7.1% in September

HSBC views a soft landing ahead for the country despite weakening export demand from the West.

The country’s import growth also slowed to a three-month low at 20.9% in September, down from its record high of 30.4% in August.

Here’s more from HSBC:

| Feeling the chill from West, but still steady Both exports and imports came in below expectations with the latter seeing a sharper deceleration due to weakening commodity import demand. With shipment orders from the G3 decelerating, notably the EU, China's export growth is on track for a slowdown. Going forward, growth momentum remained reasonably robust as shown by stabilized HSBC PMI readings in August and September. In addition, selective easing such as the State Council's newly released measures to support SMEs should further bolster growth. As such, we reiterate our view of a soft landing in China. Facts: By destination, most of the drag came from G3 markets, with exports to the EU significantly decelerated to 9.8%y-o-y in September from 22.3%y-o-y in August, while shipments to the US increased 11.6% y-o-y (vs. 12.5% in Aug.), and Japan 21.6%y-o-y in September (vs. 29.8% in Aug.). Exports to non-G3 markets also slowed but still performed well, with growth recorded 20.9%y-o-y in September vs. 28.7% in August. By product, exports of electronic and machinery products, which accounts for 57% of total export for the Jan-Sep period, decelerated 13.3%y-o-y (versus 19.3% y-o-y for Jan-Aug), the second slowest pace seen this year. For the major labor-intensive products, textiles exports decelerated to 16.7%y-o-y in Sep. from 25.2% y-o-y in Aug, clothing exports slowed down to 13.9%y-o-y in Sep. comparing with the 26.7%y-o-y in Aug. Growth of shoe exports was flat at 20.9%y-o-y in Sep. from 20.4% in Aug. China's import growth slowed to a three-month low at 20.9%y-o-y in September, down from the robust 30.4%y-o-y in August when the import value was at its record high. In seasonally adjusted terms, import growth was 8% on a month over month basis, up from the no change in August. Ordinary trade imports was still strong at 30.9%y-o-y in September (vs. 40.1% y-o-y in Aug), while processing imports just rose by 9%y-o-y in Sep. (vs. 15.1% in Aug), indicating further slowdown in China's future exports. Imports of major commodities slowed both in value term and volume term. Growth of iron ore imports slowed to 40.1%y-o-y in September (vs. 64%y-o-y in August), while growth of import quantity declined to 15.2%y-o-y in September from 32.6%y-o-y in August. In the meantime, imports of crude oil was up 25.7%y-o-y last month vs. 50.4%y-o-y in August, volume of imports saw a contraction of 12.2% from a year ago. As a result, China's trade surplus fell to 14.5bn in Sep from USD17.7bn in Aug. However, Q3 trade surplus was 63.7bn, higher than the 46.7bn trade surplus in Q2, which could attract more overseas pressure on RMB appreciation in the near term. Implications 1. Despite a moderation of IP, the current pace (13.5% y-o-y for August and 14% for July) is still comfortably fast. In addition, recently released HSBC PMI number suggests that China's manufacturing activity has shown some signs of stabilizing. 2. On the domestic front, investment and consumption growth still remained robust at 25% and 17% in August, respectively. September's import number was 20.9%y-o-y, which is still a decent growth rate, indicating a still healthy domestic demand. 3. With nearly zero contribution to growth in 1H2011, net exports' contribution to China GDP has shrunk significantly during the past few years. Bottom line: Export is on track for a slowdown that does not suggest that China will have a hard landing. Resilient domestic demand will allow China to achieve around 8.5-9% GDP growth for the coming quarters. |

Advertise

Advertise