CBD Grade A office rents dipped 1.7% in March

Demand was high for units smaller than 10,000 sqft with monthly rates of $100-$130 psf.

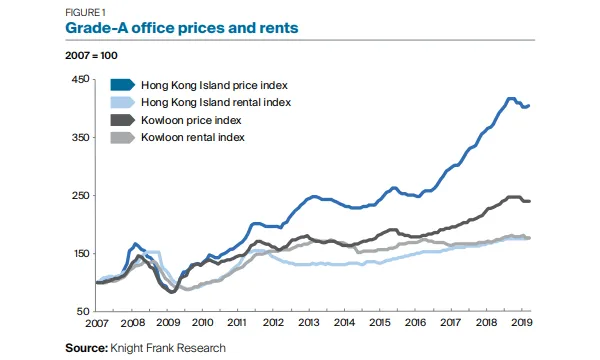

Grade A office rents in Central dipped 1.7% MoM and edged up 3.2% YoY to $161 psf per month in March, according to a report by Knight Frank.

Leasing demand for Grade A office space in Central was found to be mainly for small floor plates of less than 10,000 sqft at a monthly rent of $100-130 psf in March as global economic uncertainties continued to dent the market.

In order to reduce rental costs, a number of large multinationals and corporates have also planned to exit the CBD to decentralised areas. The Securities and Futures Commission reportedly plans to relocate from Cheung Kong Center in Central to One Island East in Quarry Bay in January 2020.

Meanwhile, there will be around 1.9 million sqft of new space available in Central and Admiralty in the coming 12 to 18 months, which is equivalent of 10% of existing stock. Given the hold-up of co-working space demand, it will significantly drive up the low Grade-A vacancy in Central and Admiralty, currently at 2%.

“Because of this, we expect rents in the CBD to soften, as landlords of premium Grade-A office buildings will be under pressure. Meanwhile, some smaller multinational corporations (MNCs) may move in to fill the vacancies, provided that landlords are willing to cut their asking rents or divide each floor into smaller units to secure occupancy,” David Ji, Knight Frank’s director of research and consultancy for Greater China, said in the report.

In Kowloon, the Grade-A office leasing market was generally active in March, with around 120 sizeable transactions recorded, which is almost double the figure seen in February. Demand was fuelled mainly by the relocation and consolidation needs of sourcing, insurance and electronics companies. Rents at Kowloon East slipped 0.4% MoM and 0.7% YoY to $32 psf per month.

One significant transaction during the month was WeWork’s lease of the 150,000 sqft space between 26/F and 31/F in the Gateway Sun Life Tower Extension in Tsim Sha Tsui. The transaction was concluded after Sun Life’s decision to leave the building, Knight Frank noted.

Apart from this take-up, the Kowloon office market was dominated by cost-conscious tenants amid economic uncertainties. Cost reduction has driven some companies to either downsize their office space or move to a co-working space.

“For example, Prudential Assurance moved to World Finance Centre South Tower in Tsim Sha Tsui from Festival Walk in Kowloon Tong and reduced their total office area by more than half,” Ji highlighted.

Advertise

Advertise