Hong Kong Stock Exchange dominates global IPO markets

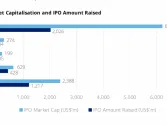

The HKEx has raised in the first 11 months of 2010 US$ 61.2 billion in 74 IPOs or 24% of the total global IPO value so far.

According to Ernst & Young’s Year-end Global IPO Update, Shenzhen Stock Exchange ranked second, raising US$40 billion (15.7%); the New York Stock Exchange third with US$31.1 billion (12.2%); Shanghai Stock Exchange fourth with US$15.9 billion (6.3%).

Shenzhen may have been the most active in terms of number of deals (288) due to demand for Chinese high growth companies and attractive pricing, but it was the Agricultural Bank and AIA listing, according to Ernst & Young, that pushed HKEx to the top in terms of value.

Max Loh, Assurance Partner and Singapore IPO Leader, Ernst & Young LLP said, “Despite market uncertainty, new IPO filings continue to increase around the world and a large backlog has built up as companies await greater macroeconomic stability.”

IPOs worldwide have already raised US$255.3 billion in 1,199 deals in the first 11 months of this year. The total global IPO value for 2010 is expected to exceed US$300 billion.

Advertise

Advertise