Check out these charts showing rich Chinese vs HK shoppers' priority shopping list

Hong Kongers prefer to go big on travel categories.

According to Agility Research and Strategy’s Affluential Insights 2015 study, while residents from both regions have clearly defined cultural differences (e.g. Hong Kong residents have free access to the Internet and not kept behind the “Great Firewall of China”), they share one common aspect: both regions have an Affluent segment that luxury brands cannot ignore.

Here's more from the study:

Hong Kong residents are already considered as some of the most Affluent in the world, while China’s Affluent demographic has been growing steadily into Asia’s largest new Affluent market. The Affluent in these regions are coveted by luxury brands. However, viewing them as similar consumer markets is a mistake that many brands make. Cultural, social, political, economic factors as well as retail availability, shopping behaviour, demographics and psychographics denote marked differences between Affluent shoppers from Hong Kong and those from China.

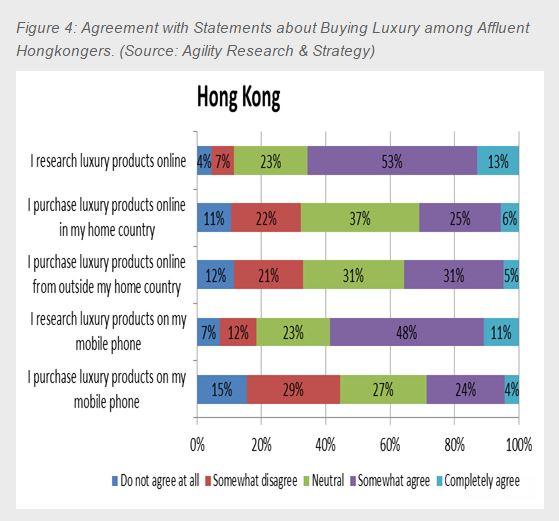

In the current consumer environment it is important for brands that cater to high-end shoppers in China to understand both their local Hong Kong resident and Chinese mainland consumer base and recognize how they differ. Agility Research recently conducted a study among a sample of 736 Affluent consumers split between Hong Kong and mainland China, studying the consumption habits of this consumer in both markets.

In our study, we asked respondents in both markets what their next most interesting luxury or big ticket purchase was. From the responses, we saw that the Affluent Chinese consumer is still very much looking to spend big on luxury goods, such as watches, bags, jewellery, fashion and accessories. At the same time their Hong Kong counterparts have the biggest budgets reserved for travel categories, although there are still many who are looking to make big purchases in luxury goods. These differences in consumption choices gives us an indication of the maturity of the Affluent consumer base.There are also some characteristics that are surprisingly similar between the two consumer groups. When asked what motivates one to purchase luxury brands, consumers in both markets ranked the importance of ten different features in the exact same order. The top five features in order of importance were: 1) Design/styling, 2) After-sales service, 3) Exclusivity, 4) Craftsmanship, and 5) Country of origin.

These findings are good news to many local brands, the implication for marketers is that in some cases the messaging aimed at triggering the consumption motivations of local and mainland Chinese consumers may not need customization.

Advertise

Advertise